Meatless alternative sales have jumped 268% in the last year

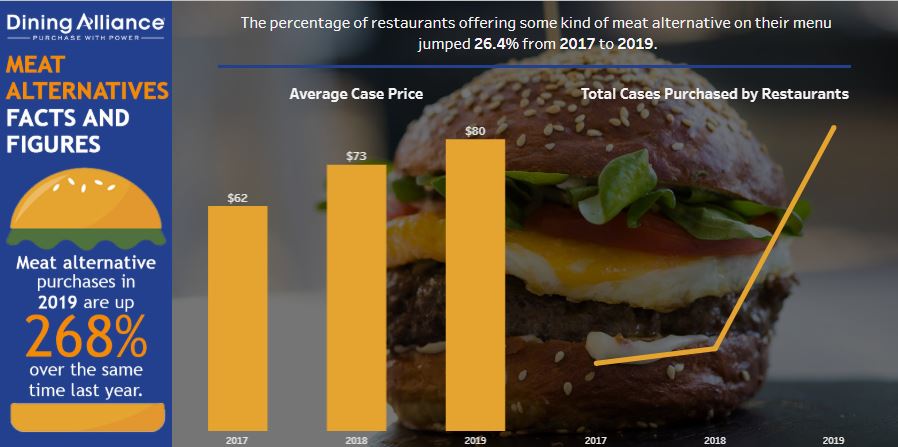

Burger King may be the first national chain to embrace meat alternatives by introducing the Impossible Whopper, but the category is hotter than a kitchen grill across all restaurant categories. Sales of meat substitute products to restaurants have soared 268% so far in 2019 compared to the same time last year. That’s according to data released today by Dining Alliance, the nation’s largest group purchasing organization for restaurants. Dining Alliance looked at meat alternative sales to date among its member restaurants compared to the same time in 2018 and 2017.

Here’s what we found:

- Meat alternative sales jumped 21.66% from 2017 to 2018

- Meat alternative sales soared 268% from 2018 to 2019

- The number of restaurants serving some kind of meat alternative jumped 26.4% from 2017 to 2019. This indicates that not only are restaurants that have already been serving meat alternatives buying more, new restaurants are adding the products to their menus.

- Half of all meat alternatives sold in 2019 have been veggie burgers with some kind of bean in it (Spicy Black Bean Veggie Burger, Chipotle Black Bean Burger, etc.)

Meat alternative products can include anything from veggie burgers, non-animal protein burgers like Impossible and Beyond meat, or synthetic sausage to put on pizzas.

- Simply put, the food has gotten better. Both Beyond Meat and the Impossible Burger have dramatically increased the quality and taste of meat substitutes to the point that they are products that restaurants feel comfortable serving.

- Restaurants are realizing that in order to compete for the segment of the market that doesn’t want to eat meat, they must do more than simply offer a variety of salads on their menu. Consumers want more options.

- Restaurants are also realizing that in many cases, they may be able to charge premium pricing for meat substitute products, which makes offering them more lucrative.

Donahue also says that the spike in popularity for meat substitute products has also led to some volatility in pricing as the market races to catch up to the growing demand. Prices for meat substitute products have jumped 29% since 2017. This has led a growing number of smaller independent restaurants to turn to group purchasing organizations like Dining Alliance to help them secure more stable, more competitive pricing. This may come as a surprise to some operators, who tend to think of GPOs as the source for staples: chicken, beef, produce, etc. But that’s not the case. Dining Alliance, for example, offers significant savings on more than 165,000 line items, including an expanding roster of meat alternatives. The margins on these meat alternative products can be significant, especially when coupled with Dining Alliance’s Cash Back programs.

For operators considering adding meat alternatives to their menu, Donahue recommends starting small and testing the market. “Before investing in bringing in a ton of new product, start with a few cases, offer it as a Limited Time Offering and see how it plays with your guests. You may want to do some special promotions on social media or via other channels that allow you to segment for the types of customers that you are looking to attract.  Then, if the products are popular with your guests, you’ll know you have a winner. With all the buzz around these products right now, the timing is perfect to ride the wave and attract guests who are specifically looking to test out alternative meat options.” Once you’ve proven the viability and profitability of having these items on your menu, we recommend working with companies like Dining Alliance to secure contracts that will guarantee that you receive competitive prices over the long term.

Then, if the products are popular with your guests, you’ll know you have a winner. With all the buzz around these products right now, the timing is perfect to ride the wave and attract guests who are specifically looking to test out alternative meat options.” Once you’ve proven the viability and profitability of having these items on your menu, we recommend working with companies like Dining Alliance to secure contracts that will guarantee that you receive competitive prices over the long term.

Donahue also encourages operators to think differently about how to use these products; It doesn’t have to just be about burgers. “Smart operators are finding success throughout their menu: in tacos, on pizzas, meatballs, nachos, chilis, sandwiches and other applications,” says Donahue. Turn the products over to your chefs and see where they can incorporate meat alternatives into existing menu items or specials. Brokers may also be a great resource for uncovering new potential applications.